ContactRelief Now Issues Alerts on FDIC Disaster Regulatory Relief

Financial institutions can now take immediate action at the Zip Code level

Monday, 24 June 2019 13:49:12 +00:00

ContactRelief announced today that its Disaster Decision Engine is now issuing alerts and recommendations based on FDIC regulatory relief instructions for disasters. The Federal Deposit Insurance Corporation (FDIC) insures bank deposits and periodically issues guidance to its members in the form of FDIC Financial Institution Letters (FILs). Financial Institution Letters (FILs) are addressed to the Chief Executive Officers of the financial institutions. FILs may announce new regulations and policies, new FDIC publications, and a variety of other matters of principal interest to those responsible for operating a bank or savings association.

FDIC issues FILs for regulatory relief following a disaster. FILs for disaster relief encourage banks to:

- Work constructively with borrowers experiencing difficulties beyond their control because of damage caused by the severe weather.

- Extend repayment terms, restructure existing loans, or ease terms for new loans, if done in a manner consistent with sound banking practices

Financial institutions may receive favorable Community Reinvestment Act (CRA) consideration for community development loans, investments, and services in support of disaster recovery. The FDIC also will consider offering the financial institution regulatory relief from certain filing and publishing requirements.

For example, see Guidance to Help Financial Institutions and Facilitate Recovery in Areas of Oklahoma Affected by Severe Winter Storms, Straight-line winds, and Tornadoes.

ContactRelief monitors the FDIC and issues a ContactRelief alert when the FDIC issues a Financial Institution Letter specifying regulatory relief for a disaster. The ContactRelief alert includes a complete geographic description of the areas identified by the FDIC down to the Zip Code level, information that is not available in the FIL issued by the FDIC. Mike Chandler, Chairman of ContactRelief, said "Financial institutions need a quick and reliable way to implement FDIC guidance. As we have done so successfully for FEMA Disaster Declarations and many other natural and man-made disasters, we now also monitor 24/7 for FDIC issued disaster guidance and provide the list of affected Zip Codes so institutions can take immediate action."

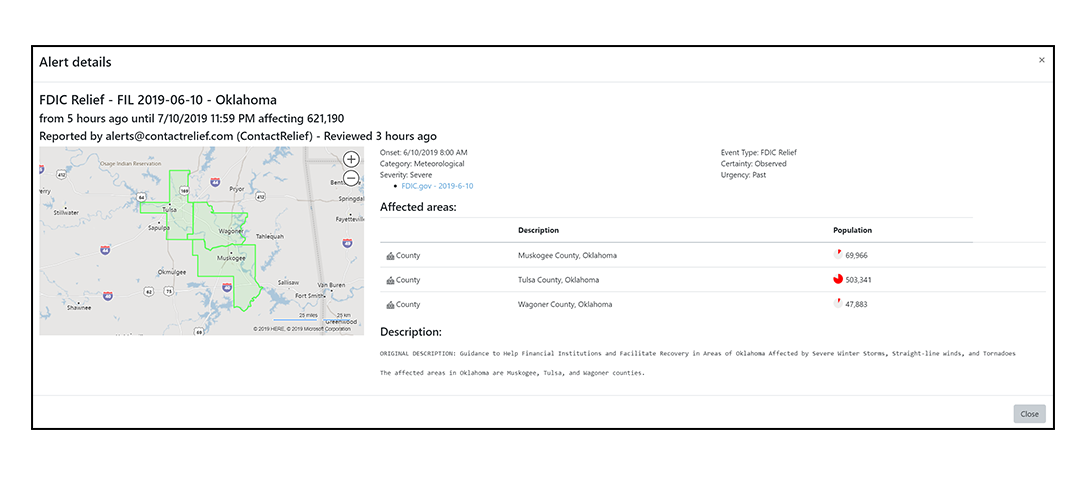

A sample FDIC Relief alert is shown below:

The ContactRelief Disaster Decision Engine is a cloud-based service that monitors 24/7 for disasters, both natural and man-made, and issues recommended actions subscribers can take to protect and promote their brand image, avoid risk from inappropriate actions, and improve operational efficiency and safety during times of disaster. ContactRelief maintains updated Zip Code boundaries and uses these to generate a list of affected Zip Codes as part of its recommendations to financial institutions.

For more information, contact info@contactrelief.com.

ContactRelief is not affiliated with the FDIC.

Protect your brand AND revenue when disaster strikes.

Try ContactRelief FREE for 30 days. Discover how we can help you reach up to 5x more customers in a disaster zone – while protecting your brand image.

Start free trial